July 2021 is a Seller's market!

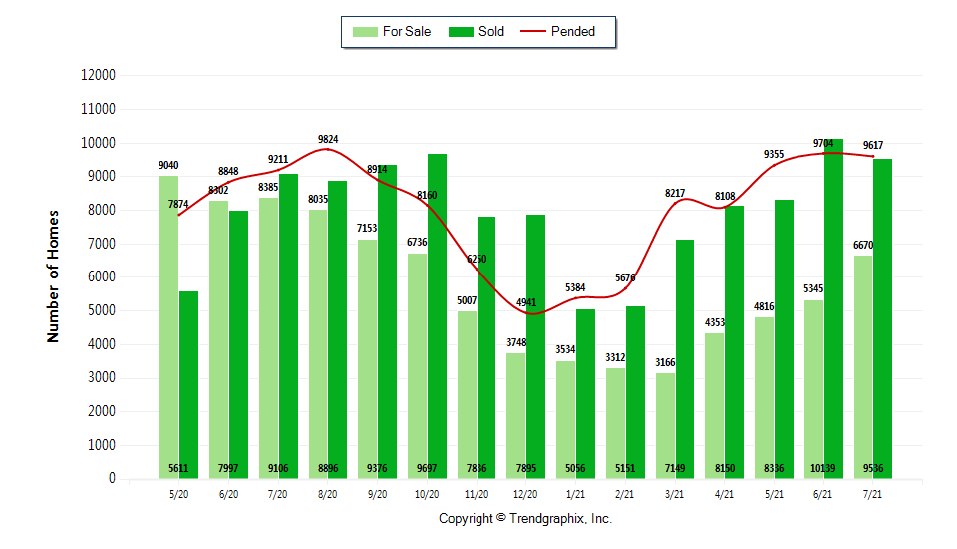

The number of for sale listings was down 20.5% from one year earlier and up 24.8% from the previous month. The number of sold listings increased 4.7% year over year and decreased 5.9% month over month. The number of under contract listings was down 0.9% compared to previous month and up 4.4% compared to previous year.

The Months of Inventory based on Closed Sales is 0.7, down 21.7% from the previous year. The Average Sold Price per Square Footage was up 1.1% compared to previous month and up 29.5% compared to last year. The Median Sold Price was the sameas last month. The Average Sold Price also increased by 0.4% from last month. Based on the 6 month trend, the Average Sold Price trend is "Appreciating" and theMedian Sold Price trend is "Appreciating".

The Average Days on Market showed a downward trend, a decrease of 58.6% compared to previous year. The ratio of Sold Price vs. Original List Price is 105%, an increase of 5% compared to previous year.

Property Sales (Sold)

July property sales were 9536, up 4.7% from 9106 in July of 2020 and 5.9% lower than the 10139 sales last month.

Current Inventory (For Sale)

Versus last year, the total number of properties available this month is lower by 1715 units of 20.5%. This year's smaller inventory means that buyers who waited to buy may have smaller selection to choose from. The number of current inventory is up 24.8% compared to the previous month.

Property Under Contract (Pended)

There was a decrease of 0.9% in the pended properties in July, with 9617properties versus 9704 last month. This month's pended property sales were 4.4% higher than at this time last year.

Although the local market is intense, buyers can find some relief because there aren't as many offers to compete with compared to earlier this year. The number of listings brokers added last month outgained the number of homes going under contract by a small margin in most areas in the report. Brokers added 12,916 new listings to the database during July. They reported 11,567 pending sales (mutually accepted offers) areawide, which covers 26 counties. At month end, there were 7,948 total listings offered for sale, down 22.5% from the year-ago total of 10,259. That was the highest level since October when inventory totaled 8,623 properties, including single family homes and condominiums.

August historically is the last month of the year with elevated levels of new listings before they slowly taper down in the fall and decline more substantially over the winter, reminding buyers they will find a better selection now than in the coming months. There is some 'normalization' in our market as it relates to the historical summer slowdown. It is suggested that the slowdown is occurring earlier this year, noting that we've also seen the warm weather in our region begin earlier which attributes some of the slowdown in real estate activity to the lifting of pandemic restrictions on June 30 when the state reopened under its "Washington Ready" plan. People are eager to enjoy the nice weather and take vacations.

Despite the extreme shortage of inventory and robust sales activity, there seems to be a bit of a leveling off from the market frenzy. This is due to a typical mid-summer season market combined with some buyer fatigue. Statistics show there were fewer pending sales last month (11,567), than during both June (12,328) and May (11,969). July's volume was down about 8.8% from the year-ago total of 12,682 pending sales.

While dangerous to compare 2020 lockdown figures to this year, it is interesting to see that new listings volume is starting to rise above 2019 levels. In July, MLS figures show member-brokers have added 1,723 more new listings of single family homes and condos than during July 2019 (12,916 versus 11,193). Year to date, brokers have added 1,438 more new listings this year compared to 2019.

Notably, 14 of the 26 counties in the MLS report showed year-over-year (YOY) gains in new listings, with half of them reporting double-digit increases: Clallam, Clark, Cowlitz, Ferry, Grays Harbor, Kitsap, and Thurston. Three of the four counties in the Puget Sound region had YOY improvement, led by Kitsap County with a jump of 29.3%. The volume of new listings in King County dropped about 5.4% from a year ago. System-wide there was a 3.2% gain in new listings versus twelve months ago. Prices continue to climb by double digits in all but a few counties. Across all areas, prices for closed sales of single family homes and condominiums (combined) jumped 21.4% during July compared to a year ago, rising from $484,995 to $589,000. Last month's median price overall was unchanged from June.

Brokers checked statistics from two years ago, noting prices in suburban counties and along much of the I-5 corridor have increased sharply. "Prices in Lewis County are up 54.2% from the July 2019 level, Snohomish County is up 40.6%, and Island County is up 44.3%. Skagit and Whatcom counties underperformed relative to these areas with median price increases of 36.4% and 38.4% respectively. Figures show four other counties have had price jumps of at least 40% -- Ferry, Grant, Grays Harbor, and Okanogan. Jefferson County had the smallest increase since 2019, with the median price increasing just over 24%, followed by Clark County, at 24.6% and King County at 26.2%.

The search for value in the suburbs with sharp price increases suggest households are making their housing preferences known. They want to own rather than rent. Unfortunately, the lack of new construction for owner occupiers over the past few years in the suburbs means first-time buyers and marginalized communities are finding it more difficult than ever to get a foot on the housing ownership ladder.

With a lack of new construction coming on the market in suburban areas after years of under building, increasing demand still has few places to go. With interest rates staying at historically low levels and less than a one-month supply throughout the region, the perfect storm for rising house prices will continue, but perhaps not as ferociously as before.

Purchasers continue to be frustrated by the sparse supply of homes, although he noted low interest rates are providing increased purchasing power. The demand for homeownership and low interest rates are fueling a very busy real estate market with buyers continuing to seek opportunities that provide more space both inside and out.

Clearly the lack of inventory of homes for sale remains the primary reasons for price increases and multiple offer situations, giving nightmares to would-be buyers. Housing affordability "has left the building," building supply chain slowdowns and a scarcity of skilled workers for homebuilding as culprits.

It is estimated that about 75% of all sold properties during the past six months in that county as well as in Kitsap and Thurston counties sold in a week or less. It can't get much faster. All three counties have barely two weeks of inventory. Figures show there is 0.73 months of inventory system-wide, with only 12 of the 26 counties in the report having more than one month of supply.

As more and more millennials enter the market, the crush of demand will grow even stronger. The recent housing activity in the region is referred to as "our 14th consecutive month of this hyper real estate market." Recent feedback from brokers confirms buyers and sellers are ready for vacations and traveling after spending so much time at home.

The overall market hasn't deviated much. The time it would take to sell all homes in inventory (month's supply) only increased about three days since June and still remains well under three weeks in most markets. That's a long, long way from a 'balanced' market of four-to-six months of inventory. It is expected that "more of the same" for the rest of the summer and beyond. We don't appear to have the forces in play to change. Low inventory, high buyer demand, low interest rates, and thousands of job openings are continuing unabated.

Know the Top 5 Things You Need To Ask For When Getting Mortgage Rates.

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates.

For more Real Estate News and Advice, please tune in to our Facebook live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com